About Telephone Audits

Set up reductions reduce earnings tax obligation where as a timetable minimizes revenue tax in addition to tax obligation. There are some rumours on showing the office deduction. Some think that pointing out the home office deduction will certainly invite an audit which is not real; not consisting of the deduction will absolutely result right into high tax obligation settlement. Individuals also think that they need to pay the exact same amount of tax obligation if you reveal home mortgage passion and real estate tax on a schedule or if you show office deduction which is not real.

Put the cash you invested to have your tax obligations prepared as well as decrease the earnings tax obligation along with the tax. You could also put the money you invested to have your tax obligations prepared on a routine yet you won’t obtain as much money back. So constantly prefer to pay much less taxes.

The reductions go through restrict which indicates that the tax payee has to adjust his assorted reductions to an amount equivalent to the modified gross earnings. So any variety of reductions you mention under particular miscellaneous deductions. There is a specified limit, which is a drawback of this timetable. It is necessary to bear in mind that only service related costs must

on-site audits be entered on your tax form. An instance would certainly be the costs you pay your represent business related products. Accounting fees must be segregated right into either business or non-business classes. You should not neglect to include the job done by your accountant like accounting, software application consulting, handling of paychecks or payroll tax returns.

Interior auditing is an independent consulting task primarily aimed at improving as well as adding worth to a business’s operations. It could be of wonderful assistance for wholesalers as it assists them much better examine their services.

There are merely numerous advantages and also benefits of inner auditing for wholesale business as it works as stimulant for improving the performance of company. With the assistance of inner bookkeeping, the dealers can attain their best objectives by bringing a self-displined as well as methodical technique to boost and assess the effectiveness of danger monitoring, administration processes as well as other controls.

Normally, lots of Wholesale business have no proper audit system and they count on their old clerks and also supposed accounting professionals. However, as their company grows, the accounts and also other management get weaker as well as this is primarily due to the unqualified employees. In these scenarios the wholesale distributors ought to certainly obtain the solutions of internal bookkeeping officer who is an expertly qualified accountant. The interior auditing officer introduces the appropriate audit system in the business and keeps economic record of every purchase. The auditor, after correct workout, could explain weak locations of monitoring and hence suggests various other choices which could generate better outcomes.

One of the most significant benefits of interior bookkeeping is that it removes the possibilities of scams in wholesale business. Without internal auditing, the opportunities of fraudulences by staffs or accountants is dramatically increased as they have complete knowledge of entire service and understand its weak points from where they could cut their share. The wholesaler himself could not track the revenue drains pipes and also scams, as he needs to do numerous other things other than accountancy. With interior bookkeeping police officer, the wholesaler will certainly be upgraded with real and clear image of his company with all scams and also profit drains pipes clearly visible. The duty of internal officer is to check all accounts consisting of amounts receivable and also payable with all above expenditures. The other benefit of internal auditing officer is that it saves huge amount of cash served on outside auditor. Typically, many business remain in the business of providing professional knowledge of exterior bookkeeping police officers, which are extremely pricey to employ. So having an inner bookkeeping officer is the most effective choice to save additional money offered on external bookkeeping. Without an auditor, it is very difficult to contrast the current efficiency of business with its previous year’s performance. It is only possible if an inner auditing policeman keeps correct record of wholesale firm’s procedures.

Lots of business embrace various tax evasion strategies by falsifying the earnings and other revenue statistics. With unqualified staff members, they are caught by government tax gathering organisations and inevitably need to pay heavy penalties. On other hand if at all they are successful to get away without paying tax obligations however they themselves loose the real figures of their company’s revenues. With interior bookkeeping police officer, they can quickly embrace tax obligation evasion strategies while also tracking their actual documents. Nowadays internal auditing has actually become the most required and highly paid task as wholesale suppliers know that the success of their wholesale service simply relies on inner auditor.

Tax obligation prep work software programs where the tax code is commonly complex and also includes several calculations which are not evident to the inexperienced are usually complicated. Lots of excellent tax obligation software application, really cost-effective, exist to help the taxpayer to complete an error free return. As instances, tax obligations on overhead and also profits are rather complex. The self employment tax obligation is an example as the clinical and also welfare portions are easily identified with a good software program. Furthermore, you are allowed to take a deduction on the amount of your tax commitment. That will be entered upon your tax return. A great tax obligation software program will certainly lead you detailed with the tax obligation prep work procedure as well as assistance to remove errors.

A Profile Of Telephone Audits

Bookkeeping is the verification task, such as evaluation or evaluation, of a process or top quality system, to make sure compliance to requirements.

An audit can relate to a whole organisation or might be details to a feature, process, or manufacturing step. Locate more details in the video, The How and Why of Bookkeeping.

An audit is a “organized, independent and also documented process for obtaining audit evidence like documents, statements of truth or other info which matter and verifiable and assessing it fairly to determine the degree to which the audit requirements based on a set of plans, procedures or demands are satisfied.”

A number of audit methods might be utilized to attain the audit function.

There are three discrete kinds of audits: product and services, procedure, as well as system. However, other techniques, such as a desk or file testimonial audit, may be utilized separately or on behalf of the 3 basic sorts of audits.

Some audits are named according to their function or range.

The range of a department or function audit is a certain department or feature. The function of a management audit relates to management interests such as evaluation of location efficiency or effectiveness.

An audit might also be categorized as interior or exterior, relying on the affiliations amongst individuals. Internal audits are executed by staff members of your organisation. External audits are performed by an outdoors representative. Internal audits are frequently described as first-party audits, while external audits can be either second-party, or third-party.

An item audit is an examination of a certain product or service to assess whether it conforms to demands like requirements, performance requirements, and also consumer needs. Nonetheless, a procedure audit is a verification that refines are working within established limits. It reviews a procedure or approach against fixed instructions or requirements to measure correspondence to these requirements and the efficiency of the instructions. Such an audit may inspect uniformity to defined requirements such as time, accuracy, temperature level, stress, make-up, responsiveness, amperage, and part blend. Analyze the sources devices, products as well as individuals related to transform the inputs into results, the setting, the approaches procedures, guidelines adhered to, and the steps gathered to figure out process performance.

Examine the adequacy as well as effectiveness of the process regulates developed by treatments, job directions, flowcharts, and also training and process requirements.

A system audit is performed on a monitoring system. It can be described as a documented task executed to validate, by assessment and examination of objective evidence, that relevant components of the system are ideal and efficient as well as have actually been developed, documented, as well as carried out in accordance and in conjunction with specified needs. A high quality monitoring system audit reviews an existing quality program to identify its correspondence to company plans, contract dedications, and regulative demands.

Likewise, an ecological system audit analyzes an ecological monitoring system, a food safety system audit takes a look at a food safety administration system, and safety and security system audits check out the security monitoring system. A first-party audit is executed within an organisation to gauge its strengths as well as weaknesses against its very own treatments or techniques and/or against external standards taken on by (volunteer) or troubled (compulsory) the organisation. A first-party audit is an internal audit carried out by auditors that are used by the organisation being audited yet who have no

manufacturing audits vested interest in the audit results of the area being examined. A 2nd celebration audit is an exterior audit done on a provider by a customer or by a contracted organisation in support of a consumer. A contract remains in location, as well as the goods or services are being, or will certainly be, provided. Second-party audits go through the guidelines of contract legislation, as they are supplying legal instructions from the consumer to the provider. Second-party audits tend to be more official than first-party audits because audit outcomes could affect the customer’s purchasing choices.

Statutory Audits System Review

Social Audits Programmes Reprise

Payment of taxes is an inescapable duty for a business owner or an entrepreneur. Government always utilizes to check the standing of tax obligation repayment at the normal interval and review if you have actually paid the appropriate amount of tax. If you want to pay sales tax to the government with no troubles by following the government’s rules as well as law, you must most likely to the tax obligation auditor like state sales tax who has actually been offering completely specialist auditing solutions for greater than 7 years. Occasionally, you are not able to offer your sales tax obligation that you have actually currently paid.

You need to comply with the below discussed pointers to provide your sales tax effectively.

The primary step in declaring tax obligations for your service is to obtain the correct paperwork from the IRS. For brand-new business owners, the documents should be rather easy, with the types specifying exactly what products as well as amounts need to be recorded.The documents must likewise ask you a few straight-forward questions about you as well as your service; all of which have to be solution totally. These inquiries consist of points like when you started the business, what items or solutions does it offer, where is the business situated, and do you have workers. One of the most important kinds to have on hand are your bookkeeping documents. These should include any finances, expenses, organisation associated bills, sales earnings, price of production, and any other type of loan that has actually entered into your business whatsoever.

Make certain that whatever recorded is done so appropriately as well as in the ideal classifications and accounts. As an example, do not submit worker incomes under making expenses. Manufacturing prices ought to just consist of the price of materials that make the items you are using, and also worker earnings should be submitted under labour expenses. You also need to determine if your business is working on a cash or amassing based audit system. A cash-based system indicates you recognise incoming or outbound cash when it is either transferred in your account or paid to a third party. An accrual based system suggests you identify inbound or outgoing cash when it is earned, also if it is not yet paid.

For instance, let’s claim you purchase a huge amount of steel from a business as well as opt to repay the purchase in month-to-month batches. On a cash-based system, you log in the audit publications the repayment monthly when you write a check to the steel business. On an accrual based system, you log in the entire lump sum the month that the first purchase was made. A lot of banks like logs that are worked on an accrual based system, but numerous business operate on a cash-based system. Whichever system you pick for your business, ensure it corresponds throughout to stay clear of any kind of confusion. One more thing to record on your tax return is whether you run your company from your residence. If you do you might declare a portion of your residence as a tax deduction for your service.

Because this is a touchy subject with a background of fraud, your house must have an assigned area that is utilized for the sole use the business. This location’s square video need to be measured, and also the square video footage of the house of a whole should be measured. After that it needs to be determined what percent of the house is being made use of for the sole purpose of the firm. That portion of house expenditures, property taxes, mortgage, and also energies could be made up as home-office expenditures and also be asserted as a deductible for business. Business owners must likewise submit vehicle expenditures that relate to their firm. For new as well as young business, there could be a lot of traveling included, as well as paying for fuel and auto maintenance could obtain very pricey the first year.

You should maintain a log in your automobile of where you travelled to, who you mosted likely to meet with, when you travelled there, how away was the location, and how much you spent in gas money. When applying for taxes as well as claiming car costs, you should state all of these points, as well as exactly how the trip mattered and purposeful to your firm. When doing your tax obligations, be sure to take into consideration the self-employment tax. Things like social safety and also Medicare taxes are usually neglected, and actually account for a big part of tax obligations payable for independent entrepreneur. Make certain to consist of these

auditing management application in your complete quarterly tax obligation settlements, and bear in mind that you are not only needed to pay for the previous year’s tax obligations, but for the initial quarter of the list below year.

This is among one of the most vital things to prepare all information and information for your sales tax in a correct fashion. It could be possible that you have paid more to the tax enthusiast. In such situation, auditor will inspect the accuracy as well as legitimacy of the amount. You have to show him your sales income tax return, graphes of accounts, company book, sales invoices, government income as well as all important documents connected to your service. Hence, you have to prepare your all deals throughout the year totally to ensure that you can show it at the time of auditing. You must promptly speak with to a sales tax obligation professional in instance of any type of issues regarding your sales tax audit. Picking a sales tax get in touch with, you should aware that they have great deals of experience in taking care of sales tax obligation as well as can compute sales tax obligation prices precisely and organise required documents for audit. A sales tax audit could be laborious along with time-consuming. Sometimes, the auditor needs to carry out a second audit for checking out the more in-depth details of your sales documents. You need to constantly prepare for it to stay clear of the auditor’s time. Furthermore, you ought to likewise keep your cash registers and the exception certificates for the second audit.

You may also appeal your situation if you locate that tax obligation auditor’s findings are not appropriate. In this case, you have to prepare with all the pertinent documents to defend on your own. Without knowing the right charm for the particular dispute resolution, you could not win your fight to buy income tax return. For this, you need to consult to a trustworthy and knowledgeable sales tax consultant who might represent your files effectively to make sure that you might really feel safe and secure yourself. State sales tax obligation might be just one of the most effective choices for your sales tax audit that can offer you completely expert services inning accordance with your financial demands and needs.

Compliance Audits System Report

Payment

quality control audits of tax obligations is an inevitable responsibility for a business owner or a business person. Government constantly utilizes to inspect the status of tax obligation payment at the normal interval and also evaluate if you have paid the appropriate quantity of tax obligation. If you wish to pay sales tax obligation to the government with no troubles by adhering to the government’s regulations and also regulation, you need to most likely to the tax obligation auditor like state sales tax who has actually been providing entirely specialist bookkeeping services for greater than 7 years. Occasionally, you are not able to provide your sales tax obligation that you have actually already paid. You ought to adhere to the below mentioned pointers to provide your sales tax obligation correctly.

The very first step in filing tax obligations for your company is to get the proper documents from the Internal Revenue Service. For new local business owner, the documents must be fairly simple, with the kinds mentioning just what items as well as quantities should be recorded.The papers need to also ask you a few straight-forward questions about you and your company; all of which have to be answer completely. These questions include things like when you began the business, what items or services does it provide, where is the business located, and do you have employees. The most essential forms to carry hand are your bookkeeping documents. These must consist of any type of lendings, expenditures, company relevant bills, sales earnings, expense of manufacturing, as well as any other type of loan that has entered into your company in all.

Make sure that whatever documented is done so correctly and in the proper categories as well as accounts. For instance, do not submit worker incomes under producing costs.

Manufacturing costs need to only consist of the expense of products that make the products you are offering, and employee wages need to be filed under labour prices. You also need to determine if your company is running on a cash money or amassing based accounting system. A cash-based system means you acknowledge incoming or outward bound loan when it is either transferred in your account or paid to a 3rd party.

An amassing based system indicates you acknowledge incoming or outgoing cash when it is made, also if it is not yet paid.

For instance, let’s state you acquire a big quantity of steel from a firm and decide to settle the purchase in month-to-month batches. On a cash-based system, you visit the bookkeeping books the payment each month when you compose a check to the steel firm. On an amassing based system, you visit the whole lump sum the month that the initial purchase was made. The majority of financial institutions prefer logs that are run on an amassing based system, however numerous companies work on a cash-based system. Whichever system you choose for your company, make certain it corresponds throughout to avoid any confusion.

An additional thing to record on your tax return is whether you run your business from your house. If you do you could declare a section of your home as a tax obligation reduction for your organisation.

Given that this is a touchy subject with a history of fraud, your home should have an assigned location that is made use of for the sole use of the business. This area’s square video need to be gauged, and also the square video footage of the house of a whole should be determined. Then it must be determined what percentage of the residence is being used for the sole objective of the company. That percentage of residence expenses, real estate tax, home mortgage, and also utilities could be accounted for as home-office expenses and be asserted as a deductible for the business. Company owner need to also file car costs that belong to their company. For new as well as young business, there could be a lot of travel involved, as well as paying for gasoline and automobile upkeep can obtain very pricey the very first year.

You should maintain a log in your automobile of where you travelled to, that you mosted likely to meet with, when you travelled there, how away was the destination, as well as how much you spent in gas loan. When declaring tax obligations and claiming vehicle costs, you need to specify every one of these things, and also how the trip was relevant and also purposeful to your company. When doing your taxes, make certain to consider the self-employment tax obligation. Things like social protection and also Medicare taxes are usually neglected, as well as actually account for a big section of tax obligations payable for freelance entrepreneur. Make certain to include these in your overall quarterly tax settlements, and bear in mind that you are not only called for to pay for the previous year’s taxes, but for the initial quarter of the list below year.

This is just one of the most important points to prepare all information as well as info for your sales tax obligation in a correct fashion. It may be possible that you have actually paid even more to the tax obligation enthusiast. In such circumstance, auditor will certainly inspect the accuracy and also validity of the amount. You need to reveal him your sales tax returns, charts of accounts, company publication, sales invoices, federal revenue in addition to all important documents associated with your business. Therefore, you have to prepare your all purchases during the year entirely so that you can reveal it at the time of bookkeeping. You need to immediately speak with to a sales tax obligation consultant in instance of any issues regarding your sales tax obligation audit. Selecting a sales tax obligation consult, you need to mindful that they have lots of experience in handling sales tax obligation and also can calculate sales tax prices precisely as well as arrange needed documents for audit. A sales tax obligation audit could be tedious along with lengthy. Occasionally, the auditor needs to perform a 2nd audit for checking out the a lot more in-depth details of your sales documents. You ought to always get ready for it to prevent the auditor’s time. Moreover, you must also keep your sales register as well as the exemption certifications for the second audit.

You could likewise appeal your situation if you find that tax auditor’s searchings for are not appropriate. In this case, you need to prepare with all the pertinent papers to protect yourself. Without understanding the correct appeal for the certain conflict resolution, you might not win your fight up for sale income tax return. For this, you need to seek advice from to a reliable as well as seasoned sales tax consultant that might represent your documents properly to ensure that you can feel safe and secure on your own. State sales tax obligation could be one of the very best alternatives for your sales tax obligation audit that could give you completely expert services inning accordance with your economic requirements and also demands.

Prescriber Audits Analysis

Just what is a quality auditor and what is the function of a top quality audit? Is a high quality audit similar to a monetary audit? Is an audit the like a monitoring or inspection? These types of questions are often asked by those unfamiliar with the high quality bookkeeping profession. Auditors are the most crucial of the high quality specialists. They should have the best and most detailed expertise of organisation, systems, growths, and so on. They see what works, what does not work, strengths, weaknesses of requirements, codes, treatments and also systems. The objective of a high quality audit is to evaluate or check out an item, the procedure utilized to generate a particular product or line of items or the system sup-porting the product to be generated. A top quality audit is additionally made use of to establish whether or not the topic of the audit is running in compliance with controling source documentation such as company regulations, government and also state environmental management legislations as well as laws, and so on

. A top quality audit identifies itself from a financial audit in that the key objective of the financial audit is to validate the honesty and accuracy of the accounting methods made use of within the organisation. Yet, despite this fundamental distinction, it is necessary to keep in mind that a number of the contemporary quality audit methods have their standard roots in economic audits. The high quality system audit addresses the who, what, where, when as well as just how of the quality system used to create its item. As an example, just how is the quality system specified? That is in charge of generating the item? That is in charge of guaranteeing the quality of the product satisfies or goes beyond consumer requirements? What is the extent of monitoring participation in the everyday procedure of the high quality system? What treatments are utilized to assist the organisation in its manufacturing effort? How are they kept and also updated? Who performs that function? Where are the procedures located?

What sort of processes are utilized (both straight and indirectly) to create the item? Exactly how do existing treatments sustain these straight and indirect procedures, etc.? A quality system audit is qualified by its emphasis on the macro nature of the top quality monitoring system. Think about the top quality system audit in regards to being wide and general in nature as opposed to narrow and also minimal in extent. A high quality system audit is specified as an organized and independent evaluation used to figure out whether high quality activities and related results abide by intended setups and whether these plans are carried out efficiently and also are suitable to accomplish objectives. In addition, it is a documented activity carried out to validate, by exam and analysis of unbiased proof, that appropriate components of the quality system appropriate and have been developed, documented as well as properly carried out in accordance with specified needs.

Where the top quality system audit is general in nature, the process audit is much more directly defined. Unlike the system audit, the procedure audit is “an inch vast but a mile deep.” It revolves around verification of the way in which people, products and devices harmonize together to generate a product. A process audit contrasts and contrasts the fashion in which the end product is produced to the created treatments, job directions, workman-ship requirements, etc., made use of to assist the manufacturing process responsible for building the item in the first place. Refine audits are evaluation as well as logical in nature. The procedure audit is additionally concerned with the validity and overall reliability of the procedure itself. For instance, is the process continually producing accept-able outcomes? Do non-value added actions exist in the process?

prescriber audits Are processes existing in regards to fulfilling the existing and future demands of vital consumers?

Bear in mind the procedure audit has 2 energetic modes of operation: appraisal and also evaluation. While in the assessment mode, keep this concern in the front of your mind: are personnel associated with the manufacturing procedure per-forming according to firm making process strategies, procedures, job guidelines, workmanship criteria, and so on? In the analysis setting, on the other hand, question the procedures, work instructions, and so forth, utilized in support of the processes being audited– are they valuable or destructive? Extensive or sketchy? Does duplication of effort exist between sub-functions? Are any non-value added steps noticeable? Does the overall procedure complement the shared or indicated high quality purposes of the organisation like short-term consumer contentment, long-lasting repeat organisation, proceeded productivity as well as growth?

Member Audits Reprise

Audits can be poor and also can lead to a considerable tax obligation bill. However remember, you should not worry.

There are different sort of audits, some minor and also some considerable, and also they all adhere to a set of specified regulations. If you know what to expect as well as follow a couple of ideal techniques, your audit might turn out to be not so bad. A little background initially. There are three types of Internal Revenue Service audits: mail, workplace and field audits. Mail audits are rather regular. They require you to mail in files responding to specific questions or ask for info from the Internal Revenue Service.

On the various other hand, workplace and also area audits are far more severe. The IRS will

performance auditing certainly not just request info to verify your deductions as well as credit ratings, however it will certainly additionally look very closely at your lifestyle, company task and also earnings to see whether your tax return is exact.

Many tax obligation evasion cases start from field audits. But don’t stress– the IRS prosecutes few taxpayers for tax obligation evasion. The IRS conserves prosecution for the most egregious tax evaders.

The IRS immediately sends out these notices when there’s a mismatch between earnings you reported on your return and also info that your employer or various other payer offered to the Internal Revenue Service through statements. An usual instance is when taxpayers don’t report the income from work they did as an independent professional during the year. As unpleasant as an Internal Revenue Service audit can be, it will not disappear. It is necessary to respond. If you do not, you will get a tax obligation costs for added tax obligations, and probably also charges. Learn how to deal with an Internal Revenue Service audit.

Take into consideration working with a tax expert right away, particularly if you are not proficient in financial tax language. Unless you can clearly express your income tax return setting to the Internal Revenue Service, you should not try to handle it yourself and wish for the best. Tax professionals trained in IRS audits will certainly give the feedback required to plainly interact your tax obligation placement. If there’s an adjustment, a tax obligation specialist can help deal with suggested penalties. Make your feedbacks full and promptly. The majority of audits and all under press reporter inquiries need matching by mail with IRS handling facilities. There is no certain person designated to your situation, so the person viewing your feedback will depend on the quality and also completeness of your reaction to translate your tax placement. If you desire the very best outcomes, respond well prior to the deadline with an organized and comprehensive feedback that describes the products concerned. Missed target dates and insufficient feedbacks lead to even more notices as well as a higher chance that the IRS will shut your audit and also analyze you extra tax obligations.

For workplace and also area audits, prepare as if the IRS were bookkeeping several years and your lifestyle. As the statistics reveal, workplace as well as area audits can cause a really high tax obligation costs. That’s since the IRS aims to see whether there is any type of unreported income on the return. As an example, the Internal Revenue Service can go through your financial institution declarations and inquiry deposits. Unexplained deposits can be taken into consideration gross income if you can not show the nontaxable resource, such as a gift or nontaxable sale of possessions. Be prepared with a response to these inescapable inquiries. A tax obligation specialist will be very valuable to assist you get ready for office and also area audits. Numerous taxpayers seek professional depiction for these types of audits.

Insist your charm legal rights when required. Know that the auditor’s choice is not final. The first allure is made to the auditor’s manager. The 2nd appeal is made to the IRS Office of Appeals. During the allures process, it is necessary to react by all due dates or you will certainly lose crucial charm rights.

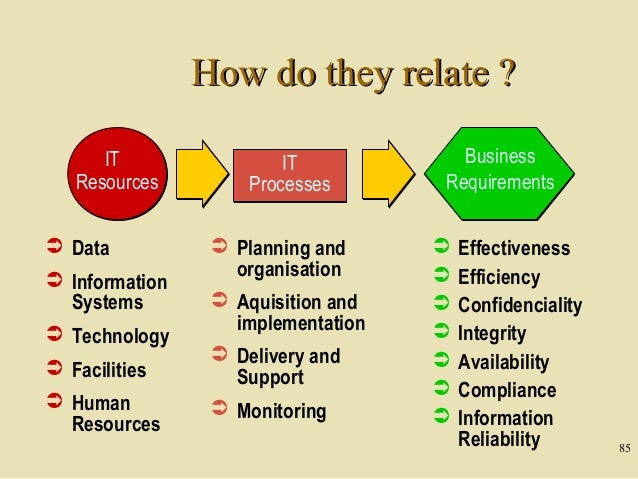

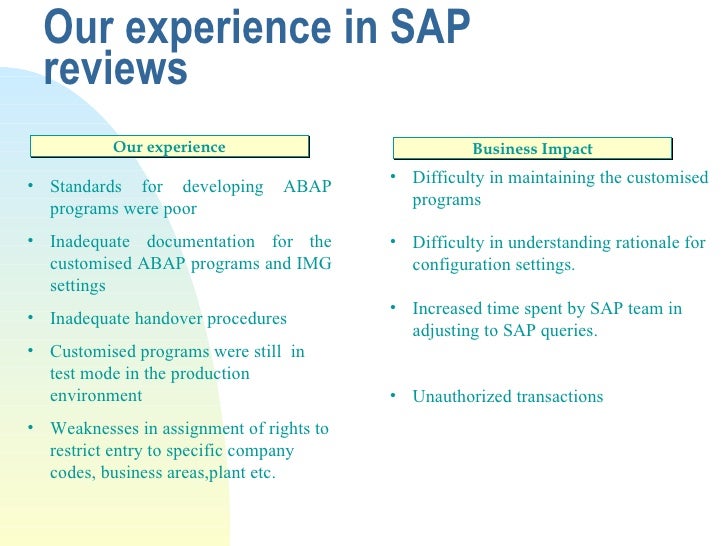

Insights Into Information Systems Audits

Clinical Audits Report

Running a business is not constantly simple; service management could be hard, particularly if you are a small or average sized company that needs to expand as well as expand gradually. In addition to appropriate management and audio financial administration concepts, acquiring a professional audit could be very useful for your organisation.

Many auditors are considereded as an independent consultant who considers your present organisation operations and also evaluate whether there are any type of issues or areas where focus is had to avoid possible responsibility. An auditor is likewise seen as a person who examines economic declarations for precision and legitimacy, to earn certain that your organisation fulfills its purposes. There are various sorts of audits, including monetary, functional, investigative, and compliance audits.

The framework forms basic component in a lot of the business we run. Be it a factory, business complicated or household structure. It was as soon as felt that structure as soon as built comes to be a permanent attribute as well as do not require any kind of maintenance or inspection. This is not real. The structure, like other equipment or body, requires regular monitoring, maintenance, and also routine maintenance. The structure remains to continue to be in the good state if this upkeep is done.

We see this occurring in case of historical structures.

Throughout the life of the structure, there are numerous celebrations when it requires modifications to accommodate new machinery, adjustment of user etc. One such instance is the task of widening of railway track from meter scale to broad gauge. The ground could support the much heavier tons of broad gauge carriages and also engines however bridges can not. This requires the analysis of existing condition and changing it to match the brand-new condition.

We always check out in papers that structures collapse. Then there is a color and cry concerning Government not taking adequate steps to avoid such disasters.

Background of building breaks down programs that the collapses occur not only in old worn out structures but it takes place to brand-new structures also. Such occurrences require government to implement guidelines which call for regular checking of problems of the structure. Sometimes there are all-natural calamities like quakes, tsunamis and so on this results in either collapse of structure or structure continues to be in a partly damaged state. When it stays in the partially damaged state, the inquiry is increased, whether it is solid enough to execute its feature for which it was building? All these prior factors cause the checking of the problem of the structure, which is known as an architectural audit.

Auditors will do greater than simply confirm monetary declarations; they will properly analyze your organisation and try to find any type of feasible locations where you could be liable for not following guidelines or standards,

field audits and also suggest you on ways to remedy this. They will see to it that your business function correctly which you adhere to all the appropriate guidelines and guidelines that regulate your certain market. A couple of benefits of obtaining a firm audit include validating your financial statements and also earnings, ensuring that your company’s sources are made use of effectively, ensuring that your firm fulfills its long- and short term goals and validating that your business is certified with the law

An inner audit will certainly concentrate more on the organization itself, its duties, features and also procedures. An internal auditor can be part of a company but they are independent of monitoring, to make sure that they can give an inner report to an audit committee. An internal auditor has a much broader range to work with, compared to an exterior auditor.

An outside audit describes the monetary and also accountancy side of an organisation. An external auditor is independent from the organisation and has a legal commitment towards shareholders and also the public, in regards to accuracy of a business’s economic statements and reports. Where an internal auditor focuses on the business overall, including its operations, an external auditor concentrates extra on the financials.

Whether you run a huge or a tiny company, you can constantly benefit from an audit solution. This could assist you when you want to send a tender in order to win an agreement, or if you want to market the business in the future. Having actually confirmed financial statements is a clear indication that your organisation is operating in accordance with the regulation and all pertinent standards.